Wool Market Reports

- Home

- About Wool

- Wool Market & Business Updates

Sign up for our newsletter!

CCWG Wool Market Update - Fall 2022

Unfortunately, the wool market continues to struggle in 2022 due to several factors. The industry is still dealing with the aftereffects of Covid-19 and global trade disruptions. For wool it has meant a significant drop in demand and lower prices with a new crop always on the way.

China in particular is still trying to maintain a zero Covid policy which is having a dramatic impact on their manufacturing and retail business. It is far from business as usual in China as the government restricts the movement of people, services and business operations in an attempt to eliminate Covid. It makes everyday life quite difficult for the Chinese people and will have a negative affect on their incomes. Clothing purchases will likely be a low priority. As an example, today there were two positive Covid cases recorded in the city of Tianjin which has a population of nine million people. Tomorrow it is mandated that all nine million residents will be Covid tested without exception. Nation wide Covid testing every seventy-two hours is still being implemented. The Chinese economy has suffered greatly as a result with consumer confidence now at an all time low.

Weather in China is also proving to be a challenge with extreme heat, drought and flooding occurring throughout various provinces in the country and affecting most of the major wool processing regions. This has resulted in a government mandate for industry to conserve energy by reducing production hours by up to two days per week or more. All of which has not been helpful to the world’s largest buyer, processor and consumer of wool. As a result, wool buying from China has been subdued especially for the broader wool types. There is no disputing that the large population of China consumes significant quantities of almost every commodity. Wool is no exception; wool market recovery will be contingent on an improvement in the Chinese economy. The threat of climate related supply chain disruptions is now real and could have further global repercussions, especially for food production and distribution. Labour shortages appear to be a global phenomena and like many other industries it has also had an impact on the production and marketing of wool products.

Although the wool market outlook still appears to be somewhat bleak, conditions will improve in time. We are already witnessing some change and a return to more stable shipping logistics which is a positive sign. In the interim we continue our efforts to market graded and objectively measured Canadian wool to our network of domestic and international wool buyers. While current opportunities are somewhat limited and the wool business is quite slow, we are optimistic that the tide will eventually turn, and better conditions will soon prevail. The positive attributes of wool as a naturally sustainable fiber that is comfortable, renewable and biodegradable is gaining momentum at the expense of synthetic’s that are falling out of favor due to widespread concerns about pollution.

We encourage producers to continue shipping their wool to the closest depot so that we have it ready when marketing opportunities arise. Proper storage on farm is also an option to consider if wool bags are well packed and storage facilities are available. As always, the better quality and well-prepared wool clips are much easier to market and prices are still reasonable, all things considered in the marketplace.

CCWG is currently researching how we might process and market some of our lower quality and low value wool types. The company is prepared to make the capital investment that may be required if it is determined that there are viable value-added opportunities to process and market these wool types in non traditional ways. We are also providing financial support towards wool research and development proposals, with the objective of achieving innovation for developing wool products and new marketing opportunities for Canadian wool.

CCWG continues to collect wool across the country through our extensive wool depot network and wool grading continues on a daily basis. We thank all producers for your patronage and your continued support and patience as we navigate through these unprecedented times.

Yours sincerely,

Eric Bjergso

General Manager

Mise à jour du marché de la laine août 2022

Malheureusement, le marché de la laine a encore des difficultés en 2022 en raison de plusieurs facteurs. L'industrie est toujours aux prises avec les séquelles de la Covid-19 et les perturbations du commerce mondial. Pour la laine, cela s'est traduit par une baisse significative de la demande et des prix plus bas.

La Chine en particulier essaie toujours de maintenir une politique zéro Covid qui a un impact dramatique sur ses activités de fabrication et de vente au détail. C'est loin d'être comme d'habitude en Chine car le gouvernement restreint la circulation des personnes, des services et des opérations commerciales dans le but d'éliminer le Covid. Cela rend la vie quotidienne assez difficile pour les résidents chinois et a un effet négatif sur leurs revenus. Les achats de vêtements seront probablement une faible priorité. À titre d'exemple, aujourd'hui, deux cas positifs de Covid ont été enregistrés dans la ville de Tianjin, qui compte une population de neuf millions d'habitants. Demain, il est obligatoire que les neuf millions d'habitants soient testés Covid sans exception. Des tests Covid à l'échelle nationale toutes les soixante-douze heures sont toujours en cours. L'économie chinoise en a beaucoup souffert, la confiance des consommateurs étant désormais au plus bas.

La météo en Chine s'avère également être un défi avec la chaleur extrême, la sécheresse et les inondations qui se produisent dans diverses provinces du pays et affectent la plupart des principales régions de transformation de la laine. Cela a abouti à un mandat du gouvernement pour que l'industrie conserve l'énergie en réduisant les heures de production jusqu'à deux jours par semaine ou plus. Tout cela n'a pas aidé le plus grand acheteur, transformateur et consommateur de laine au monde. En conséquence, l'achat de laine en Chine a modéré, en particulier pour les types de laine plus larges. Il ne fait aucun doute que la grande population chinoise consomme des quantités importantes de presque tous les produits de base. La laine ne fait pas exception, la reprise du marché de la laine dépendra d'une amélioration de l'économie chinoise. La menace de perturbations de la chaîne d'approvisionnement liée au climat est désormais réelle et pourrait avoir d'autres répercussions mondiales, en particulier pour la production et la distribution alimentaires. Les pénuries de main-d'œuvre semblent être un phénomène mondial et, comme de nombreuses autres industries, elles ont également eu un impact sur la production et la commercialisation des produits en laine.

Bien que les perspectives du marché de la laine semblent encore quelque peu sombres, les conditions s'amélioreront avec le temps. Nous assistons déjà à des changements et à un retour à une logistique d'expédition plus stable, ce qui est un signe positif. Dans l'intervalle, nous poursuivons nos efforts pour commercialiser la laine canadienne classée et mesurée objectivement auprès de notre réseau d'acheteurs de laine nationaux et internationaux. Bien que les opportunités actuelles soient quelque peu limitées et que le secteur de la laine soit assez lent, nous sommes optimistes quant au fait que le vent finira par tourner et que de meilleures conditions prévaudront bientôt. Les attributs positifs de la laine en tant que fibre naturellement durable, confortable, renouvelable et biodégradable gagnent du terrain au détriment des fibres synthétiques qui perdent en popularité en raison des préoccupations généralisées concernant la pollution.

Nous encourageons les producteurs à continuer d'expédier leur laine au dépôt le plus proche afin que nous l'ayons prête lorsque des opportunités de commercialisation se présenteront. Un entreposage approprié à la ferme est également une option à considérer si les sacs de laine sont bien emballés et si des installations d’entreposage sont disponibles. Comme toujours, les lots de laine de meilleure qualité et bien préparées sont beaucoup plus faciles à commercialiser et les prix restent raisonnables, toutes choses considérées sur le marché.

Le CCWG étudie actuellement comment nous pourrions traiter et commercialiser certains de nos types de laine de qualité inférieure et de faible valeur. La société est prête à faire l'investissement en capital qui pourrait être nécessaire s'il est déterminé qu'il existe des opportunités viables à valeur ajoutée pour transformer et commercialiser ces types de laine de manière non traditionnelle. Nous fournissons également un soutien financier aux propositions de recherche et développement sur la laine, dans le but d’innover pour développer des produits en laine et de nouvelles opportunités de commercialisation pour la laine canadienne.

Le CCWG continue de collecter la laine à travers le pays grâce à notre vaste réseau de dépôts de laine et le classement de la laine se poursuit quotidiennement. Nous remercions tous les producteurs pour votre appui continu et votre patience alors que nous traversons ces temps sans précédent.

Respectueusement soumis,

Eric Bjergso

Directeur Général

CCWG Wool Market and Business Update – Fall 2021

2020 / 21 Wool Market Update

Wool marketing in 2020/21 has been very challenging to say the least and without a doubt the most difficult conditions that I have experienced in my career with CCWG. The start of our new wool season in March 2020 coincided with a global shutdown as most countries implemented lockdown policies, restricted travel and personal contact along with initiating other strict health and safety measures to control the spread of the highly contagious

Covid-19 pandemic. Most retail clothing stores were classified as non-essential service and were required to close several times throughout the year. This resulted in the widespread cancellation of contracts and negatively impacted the entire textile supply chain. All of these factors have contributed to the current depressed state of the wool market. More than 18 months later a great deal of progress has been made with wide spread international immunization, but the problem has not disappeared as we continue to battle the 4th wave Delta variant in Canada.

We had previously reported that global trade has suffered high loses due to Covid-19 and the textile industry has been no exception. Although there has been a modest recovery in fine wool prices since the low point of September 2020, the broader types continue to struggle to find an equitable balance between supply and demand. There are a number of initiatives under research worldwide for new product innovation which is encouraging but this will take time to bring these products to the marketplace. The trade recognizes that as an industry more needs to be done in educating todays consumer on the many benefits of wool, a natural and renewable resource. This will be critical in order to compete with current fast fashion trends that are made almost exclusively from synthetic fibers. Our situation in Canada is not unique with significant unsold wool inventory in every sheep and wool producing country of the world. Although there are reasonable marketing opportunities for best quality and well prepared wool types, the market is fairly saturated with the available supply of other wool types of lesser quality. These wools tend to be more difficult to sell in a down market because they pose a higher risk to the buyer and the financial incentive to buy is not significant enough to entice them under the current market conditions. As global business slowly returns to more normal trading conditions it is somewhat difficult to be optimistic for the short term. Post Covid the wool trade is encountering new hurdles that will take time to resolve.

There seems to be a shortage of qualified labour in numerous industries including textiles. Hopefully this scenario will improve as generous unemployment benefits expire. There are also gaps in the supply chain along with unprecedented challenges in transportation logistics. This translates into higher costs and tighter available supplies for container and trucking options. As an example Trans-Pacific shipments are up 30% this year which explains part of the reason for the current container shortage. Even more significant is the incredible fact that ocean freight for a 40’ container from China port to North America has increased to nearly $20,000 USD from only $2,000 USD a year ago!

This situation is a direct result of the global economy playing catch up by ramping up manufacturing production in numerous sectors. Unfortunately, the wool market has not yet been able to capitalize on this global phenomena.

The recent news of an energy crisis in China and India is also very concerning and won’t be helpful towards a wool market recovery. Reports indicate that a wide range of industries

in China will be mandated by government to reduce production by as much as 30% to conserve electricity and reduce greenhouse gas emissions. All of these factors point toward a continued challenging wool market for the foreseeable future.

Despite the unforeseen wool market conditions that Covid-19 has created, at CCWG we have continued with an uninterrupted wool collection, wool grading and marketing service for Canadian sheep producers. Wool consignments were down approximately 17% with some producers opting to store wool on farm until improved wool market conditions prevail. The company is fortunate to have developed excellent markets over many years for Canadian wool in Canada, China, USA, Czech Republic, and Egypt. Sales have also been concluded in Bulgaria, India and Uruguay. Canadian wool is known for its soft handle and has earned an excellent reputation in these markets for the consistent quality of our deliveries. All of our Canadian wool is now tested by New Zealand Wool Testing Authority to produce objective measurement reports. This became necessary when the American lab, Yocom McColl Wool Testing Lab Inc was closed in early 2020. It is important to consider that the present dilemma of the wool market is a global situation and a direct result of Covid which we cannot control. It is not isolated to Canadian wool and has had a detrimental effect on the market for wool from many origins. CCWG is well positioned to participate in a wool market recovery that will eventually come to pass as our everyday life styles and business trade gradually return to more normal.

CCWG Business Update

Despite the added pressures of conducting business and the challenges of supply chain management during the Covid-19 pandemic, our retail continues to excel and grow. With foot traffic into our stores restricted at various times throughout the year, it presented a chance for time well spent designing, updating and expanding our ecommerce platforms. A valuable lesson learned during the pandemic has been the great opportunities that exist to increase online sales with effective social media promotions through our existing brick and mortar locations.

In our 103rd year of business, the company continues to operate a national network for wool collection and marketing services. In addition, our retail business which is comprised of a wide range of products including farm, hobbyist and consumer goods is now the backbone of the company in terms of revenue generated. This diversification has served the company well and ensured our continued success. Our motto continues to be the right product at the right price delivered with exceptional customer service. I would be remiss if I did not extend sincere appreciation and thanks to a fantastic CCWG staff, operating right across the country in several locations. They continue to be the companies most valuable asset. Everyone from administration, retail and wool services has delivered their usual stellar performance this past year working under extremely challenging and unusually difficult circumstances. On behalf of management and the Board of Directors we give you our heartfelt thanks for a job well done. We are also very fortunate to have a loyal customer base that play a large role in the success of CCWG and we are truly grateful for your patronage.

Although we are all hopeful that Covid will soon be behind us and life will return to normal, we will still need to use caution and not let our guard down. It is somewhat of a cliché to say that we must continue to be calm and carry on but it is true, that is what we must do. I think it is also reasonable to suggest that in the days and weeks to come we should be prepared to expect the unexpected as we work towards resuming our usual business practice and procedures.

Best wishes to everyone for good health and successful markets in 2022.

Respectfully submitted,

Eric Bjergso

General Manager

Canadian Co-operative Wool Growers Limited

Mise à jour d’affaires et du marché de la laine de la CCWG – automne 2021

Mise à jour du marché de la laine 2020-21

Le marketing de la laine en 2020 a été pour le moins très difficile et sans doute les conditions les plus difficiles que j’ai connues au cours de ma carrière à la CCWG. Le début de notre saison en mars 2020 a coïncidé avec un arrêt mondial alors que la plupart des pays ont mis en place des politiques de confinement, des restrictions de voyages et de contacts personnels ainsi que d’autres mesures strictes de santé et de sécurité pour contrôler la propagation de la pandémie hautement contagieuse. La plupart des magasins de vêtements au détail ont été classés dans la catégorie des services non essentiels et ont dû fermer plusieurs fois au cours de l’année. Cela a entraîné l’annulation généralisée des contrats et a eu un impact négatif sur l’ensemble de la chaîne d’approvisionnement du textile. Tous ces facteurs ont contribué à l’état réprimé actuel du marché de la laine. Plus de 18 mois plus tard, de nombreux progrès ont été réalisés dans le domaine de la vaccination internationale à grande échelle, mais le problème n’a pas disparu alors que nous continuons à lutter contre la variante Delta de la 4e vague au Canada.

Nous avions précédemment signalé que le commerce mondial avait subi de lourdes pertes en raison de la Covid-19 et l’industrie du textile n’a pas fait exception. Bien qu’il n’y ait pas eu une modeste reprise des prix de la laine fine depuis le point le plus bas en septembre 2020, les types de laines plus grossières continuent de tenter de trouver un équilibre équitable entre l’offre et la demande. Il y a un certain nombre d’initiatives de recherches dans le monde entier pour l’innovation de nouveaux produits, ce qui est encourageant, mais cela prendra du temps pour mettre ces produits sur le marché. Le commerce reconnaît qu’en tant qu’industrie, il faut faire davantage pour éduquer les consommateurs sur les nombreux avantages de la laine, une ressource naturelle et renouvelable. Ce sera essentiel pour rivaliser avec les tendances actuelles des vêtements de la mode« rapide» qui sont fabriqués presque exclusivement à partir de fibres synthétiques. Notre situation au Canada n’est pas unique, tous les pays producteurs de moutons et de laine se retrouvent avec un important inventaire de laine non vendue. Bien qu’il existe des possibilités de commercialisation raisonnables pour les de laines de meilleure qualité et bien préparées, le marché est assez saturé avec l’offre d’autres types de laine de moindre qualité. Ces laines ont tendance à être plus difficiles à vendre dans un marché faible parce qu’ils posent un risque plus élevé pour l’acheteur et l’incitation financier à acheter n’est pas assez important pour les attirer dans les conditions actuelles du marché. Comme les affaires mondiales reviennent lentement à des conditions commerciales plus normales, il est difficile d’être optimiste à court terme. Après la pandémie de la Covid-19, le commerce de la laine envisage de nouveaux obstacles qui prendront du temps à surmonter.

Il semble y avoir une pénurie de main-d’œuvre qualifiée dans de nombreuses industries, y compris le textile. Espérons que ce scénario s’améliorera à mesure que les généreuses prestations de chômage expireront. Il y a aussi des lacunes dans la chaîne d’approvisionnement et des défis sans précédent dans la logistique du transport. Cela se traduit par des coûts plus élevés, une diminution de la disponibilité des conteneurs, ainsi qu’une altération des options de camionnage. Par exemple, les expéditions Trans-Pacific ont augmenté leurs prix de 30% cette année, ce qui explique en partie la pénurie actuelle de conteneurs. Ce qui est encore plus important, c’est le fait incroyable que le fret maritime pour un conteneur de 40 pieds entre un port chinois et l’Amérique du Nord est passé de 2 000$ US il y a un an, à près de 20 000$ US aujourd’hui!

Cette situation est le résultat direct du rattrapage de l’économie mondiale en augmentant la production manufacturière dans de nombreux secteurs. Malheureusement, le marché de la laine n’a pas encore été en mesure de tirer profit de ce phénomène mondial.

La nouvelle récente d’une crise énergétique en Chine et en Inde est également très préoccupante et n’aidera pas à la reprise du marché de la laine. Des rapports indiquent qu’un large éventail d’industries en Chine seront mandatées par le gouvernement pour réduire la production jusqu’à 30% afin de conserver l’électricité et réduire les émissions de gaz à effet de serre. Tous ces facteurs indiquent un marché de la laine toujours difficile dans un avenir prévisible.

Malgré les conditions imprévues du marché de la laine que la Covid-19 a créées, la CCWG a continué d’offrir un service ininterrompu de collecte, de classement et de commercialisation de la laine aux éleveurs de moutons canadiens. La collecte de la laine a diminué d’environ 17%, certains producteurs ayant choisi d’entreposer la laine à la ferme jusqu’à ce que les conditions du

marché de la laine s’améliorent. L’entreprise a la chance d’avoir développé d’excellents marchés pour la laine canadienne au Canada, en Chine, aux États-Unis, en République Tchèque et en Égypte. Des ventes ont également été conclues en Bulgarie, en Inde et en Uruguay. La laine canadienne est reconnue pour sa souplesse et a acquis une excellente réputation auprès de ces marchés pour la qualité constante de nos livraisons. Toute notre laine canadienne est maintenant évaluée par la « New Zealand Wool Testing Authority » afin de produire des rapports de mesures objectifs. Cela est devenu nécessaire lorsque le laboratoire américain «Yocom McColl Wool Testing Lab Inc » a fermé ses portes au début de 2020. Il faut tout de même tenir compte que le dilemme actuel du marché de la laine est une situation mondiale et un résultat direct de la Covid-19 que nous ne pouvons pas contrôler. Elle n’est pas limitée à la laine canadienne et a eu un effet néfaste sur le marché de la laine de nombreuses origines. La CCWG est bien placée pour participer à une reprise du marché de la laine qui se produira au fur et à mesure que nos styles de vie quotidienne et le commerce d’affaires reviennent progressivement à la normale.

Mise à jour d’affaires de la CCWG

Malgré les pressions supplémentaires liées à faire affaires et les défis liés à la gestion de la chaîne d’approvisionnement pendant la pandémie de la Covid-19, notre clientèle de détail continue d’exceller et de croître. Avec les restrictions de pouvoir se présenter en personne dans nos magasins à divers moments de l’année, nous avons eu la chance de consacrer du temps à la conception, à la mise à jour et à l’expansion de nos plateformes de cybercommerce. Une leçon précieuse apprise pendant la pandémie a été les grandes occasions qui existent d’augmenter les ventes en ligne grâce à des promotions efficaces des médias sociaux dans à nos emplacements existants.

Au cours de notre 103e année d’activité, l’entreprise continue d’exploiter un réseau national de services de collecte et de commercialisation de la laine. De plus, notre commerce de détail, qui comprend une vaste gamme de produits, y compris des produits agricoles, des produits de loisir et des biens de consommation, est maintenant l’ossature de l’entreprise en termes de revenus générés. Cette diversification a bien servi l’entreprise et a assuré notre succès continu. Notre devise continue d’être : le bon produit, au bon prix, livré avec un service client exceptionnel. Je m’en voudrais de ne pas remercier sincèrement le personnel fantastique de la CCWG, qui exerce ses activités à plusieurs endroits partout au pays. Il continu d’être l’actif le plus précieux de l’entreprise. Tous, de l’administration, de la vente au détail, jusqu’aux services de la laine, ont livré une performance sublime au cours de la dernière année, tout en travaillant dans des circonstances extrêmement difficiles et avec plus de défis. Au nom de la direction et du conseil d’administration, nous vous offrons nos plus sincères remerciements pour un travail bien fait. Nous sommes également très chanceux d’avoir une clientèle fidèle qui joue un grand rôle dans le succès de la CCWG et nous sommes vraiment reconnaissants pour votre patronage.

Même si nous espérons que la Covid-19 soit bientôt derrière nous et que la vie revienne à la normale, nous devons tout de même faire preuve de prudence et de vigilance. C’est un peu un cliché de dire qu’il faut rester calme et continuer, mais c’est vrai, c’est ce qu’il faut faire. Je pense qu’il est également raisonnable de suggérer que, dans les jours et les semaines à venir, nous devrons être prêts et nous attendre à l’imprévu alors que nous nous apprêtons à reprendre nos pratiques et procédures commerciales habituelles.

Meilleurs vœux à tous pour une bonne santé et des marchés fructueux en 2022.

Respectueusement soumis,

Eric Bjergso

Directeur Général

QUEBEC WEST / OUEST DIRECTOR VACANCY

David Mastine was a CCWG Director since 1999 and President since 2015. He recently resigned from the Board due to other personal commitments. We thank him on behalf of the Board of Directors, staff and shareholders for his many years of loyal and dedicated service to CCWG.

The position is now open to accept Director nomination ballots for the position until January 31, 2022. Any Quebec West / Ouest shareholder may apply for the position.

David Mastine était administrateur de la CCWG depuis 1999 et président depuis 2015. Il a récemment démissionné du conseil en raison d’autres engagements personnels. Nous le remercions au nom du conseil d’administration, du personnel et des actionnaires pour ses nombreuses années de loyaux et dévoués services à la CCWG.

Il est maintenant possible d’accepter les bulletins de mise en candidature pour le poste jusqu’au 31 janvier 2022. Tout actionnaire de Québec Ouest peut poser sa candidature.

For more information please contact: / Pour de plus amples renseignements, veuillez communiquer avec :

| Anita Reid, Office Administrator / Administratrice de bureau Canadian Co-operative Wool Growers Limited Box 130, 142 Franktown Road Carleton Place, ON K7C 3P3 613-257-2714 Ext 203 Fax 613-257-8896 [email protected] www.wool.ca |

Eric Bjergso, General Manager / Directeur Général |

Historic price slump fleeces wool producers, with Carleton Place co-op in the middle.

'It seems that clothing demand in a global pandemic isn’t a high priority'. Eric Bjergso calls it the deepest wool slump ever experienced by the industry.

Click the link or picture above for the full story from the:

Ottawa Business Journal

By: Tom Van Dusen - Sept 14th 21

Wool Market Update Spring 2021

The wool market continues to struggle in 2021 due to the ongoing effects of the global Covid pandemic. Fine wools have made better recovery progress but marketing broader wool types can be a challenge, particularly for grades containing high vegetable matter and with low yields or poor colour. There is a surplus of unsold coarser wool types in every wool producing country in the world with a new clip coming to market. This is mainly due to the China / USA trade conflict in 2019 and then followed by Covid-19 which has had a dramatic impact on wool demand from March 2020 onwards. However, we are seeing some signs of improvement which is encouraging.

The entire global textile chain has been impacted for various reasons, some of which are as follows.

- Many mills have operated at significantly reduced capacity due to Covid and cancelled contracts. Most are still not back to fully normal operating conditions.

- It seems that clothing demand in a global pandemic is not a high priority. Many shops are still closed worldwide because they are not classified as an essential service.

- More people are working from home with a virtual office and significantly diminished or cancelled in person meetings, social events and other activities are all having an influence on demand for textiles at the present time. There is not an urgency by the consumer to buy new clothing.

There are high hopes that the worldwide vaccine roll out will be the ultimate goal in defeating Covid, ultimately restoring consumer confidence, returning to regular business conditions and our previous normal lifestyle. The wool trade in general supports this point of view and there is optimism that it is realistic this will be achievable at some point in time during 2021.

At CCWG we have continued our efforts to market Canadian wool when there is an opportunity to do so to our long established domestic and international wool buyers. We are still accepting wool at all of the company’s extensive national wool depot network and wool grading has continued uninterrupted as well. Although wool sales continue to be slow, wool payments to producers are now being processed.

Our sincere thanks to Canadian sheep producers for your business, cooperation and patience during this unusually difficult wool marketing period. Our best wishes to all for successful marketing in 2021.

Yours truly,

Eric Bjergso

General Manager

MISE À JOUR DU MARCHÉ DE LA LAINE PRINTEMPS 2021

Le marché de la laine continue de se débattre en 2021 en raison des effets persistants de la pandémie mondiale de la Covid. Les laines fines ont fait de meilleurs progrès, mais la commercialisation des types de laine plus larges peut être un défi, en particulier pour les catégories contenant une forte teneur en matière végétale et avec de faibles rendements ou une mauvaise couleur. Il y a un surplus de types de laines plus grossières invendues dans tous les pays producteurs de laine. Cela est principalement dû au conflit commercial Chine / États-Unis en 2019, puis suivi par la Covid-19 qui a eu un impact dramatique sur la demande de laine à partir de mars 2020. Cependant, nous voyons des signes d'amélioration, ce qui est encourageant.

L'ensemble de la chaîne textile mondiale a été impactée pour diverses raisons, dont certaines sont les suivantes.

- De nombreuses usines ont fonctionnées à une capacité considérablement réduite en raison de la Covid et des contrats annulés. La plupart ne sont toujours pas revenus à des conditions de fonctionnement tout à fait normales.

- Il semble que la demande de vêtements pendant une pandémie mondiale ne soit pas une priorité. De nombreux magasins sont toujours fermés dans le monde car ils ne sont pas classifiés comme un service essentiel.

- De plus en plus de personnes travaillent à domicile avec un bureau virtuel et les réunions en personne, les événements sociaux et d'autres activités sont considérablement réduits ou annulés ce qui a une influence sur la demande de textiles à l'heure actuelle. Il n'y a pas d'urgence de la part du consommateur à acheter de nouveaux vêtements.

Il y a de grands espoirs que le déploiement mondial du vaccin sera le but ultime pour vaincre la Covid, pour enfin restaurer la confiance des consommateurs, revenir à des conditions commerciales normales et à notre mode de vie normal antérieur. Le commerce de la laine en général soutient ce point de vue et est optimiste que cela soit réalisable à un certain moment en 2021.

Chez CCWG, nous avons poursuivi nos efforts pour commercialiser la laine canadienne lorsque l'occasion se présente de le faire auprès de nos acheteurs de laine nationaux et internationaux établis depuis longtemps. Nous acceptons toujours la laine dans tout le vaste réseau national de dépôts de laine de la compagnie et le classement de la laine s'est également poursuivi sans interruption. Bien que les ventes de laine continuent d'être lentes, les paiements de laine aux producteurs sont actuellement en cours de traitement.

Nos sincères remerciements aux éleveurs de moutons canadiens pour votre coopération et votre patience pendant cette période de commercialisation de la laine particulièrement difficile. Nos meilleurs vœux à tous pour une commercialisation réussie en 2021.

Votre sincèrement,

Eric Bjergso

Directeur général

CCWG Wool Market and Business Update – Fall 2020

2019 / 20 Wool Market Update

CCWG Business Update

Respectfully submitted,

Eric Bjergso

General Manager

Mise à jour d’affaires et du marché de la laine de la CCWG – automne 2020

Mise à jour du marché de la laine 2019-20

CCWG Wool Market & Business Update – Fall 2019

2018/19 Wool Market Update

The wool market has been experiencing quite a rough ride for the current wool marketing year. During the first quarter the market seemed to be on track for stable conditions with both fine wool and crossbred types achieving reasonable prices and demand. There were expectations at the time that good progress was being made for a new China / USA trade agreement.

This situation however was short lived from April onwards as a number of factors came into play. Traditionally the market for wool is at its best and consumer confidence is greatest when there is positive growth in global economies and a stable worldwide political environment. The current situation of widespread indecision and uncertainty has had a detrimental effect on all value chain partners within the entire wool textile industry. China is the world’s largest market for woolen garments of which approximately 45% is for domestic consumption and the remaining 55% for export. The escalation of the China / USA trade conflict, with time lines for increased tariff’s put in place by both sides has had a major negative impact on the market.

Wool prices have been quite volatile which has created chaotic conditions for mills and the consequences of de-valued inventories. In August the Australian market dropped by more than 35%, the market has since managed to claw back some of these losses in September and October. For several months mills in China have been operating on reduced production schedules from 30% to 60%. Due to weak demand, stocks throughout the entire wool textile pipeline have been building in China and around the globe. Cash flow has been very much restricted as a result. European processors have reported that consumer demand has dropped by more than 20 percent, again due to trade and economic uncertainty from the trade war and other problems such as Brexit and tensions in the Middle East. Due to the overall state of the global economic situation, consumers are spending less on clothing which is affecting the entire global textile sector. Consumer confidence throughout China, Europe and other major economies has been severely affected by trade and fears of a worldwide recession.

Most of the major wool producing countries have experienced declines in wool exports of approximately 10% to 15% compared to a year ago which is mostly attributable to weaker global demand for wool. In Australia there has been no relief in the severe drought conditions that have existed for quite some time. Wool production has been hit hard due to these difficult seasonal conditions as producers have been forced to de-stock due to feed shortages. Wool production in Australia has declined by 14% compared to a year ago and there has been a downward trend now for several years. In NZ sheep numbers also continue to decline and wool production is lower by 2.5% compared to a year ago.

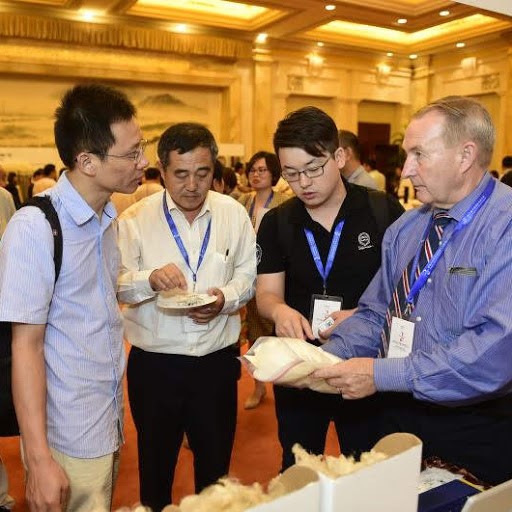

The Nanjing Wool Market Conference was recently held in Qufu, Shandong China where 500 representatives from 26 countries attended. The conference is an annual meeting of the global wool industry that facilitates discussion on current industry issues, future developments and market opportunities. The general consensus at the conference was that wool prices are likely to remain volatile for the next few months and possibly into 2020 before a more sustained and modest improvement will occur. A bright spot for the Chinese industry has been the popularity of two new star products that utilize significant fine wool and some broader wools to a lesser degree. Double sided wool fabric and fake faux fur (replicating wool for fur) for winter coats have been selling very well in the Chinese domestic market, examples are attached to this report.

The Nanjing Wool Market Conference was recently held in Qufu, Shandong China where 500 representatives from 26 countries attended. The conference is an annual meeting of the global wool industry that facilitates discussion on current industry issues, future developments and market opportunities. The general consensus at the conference was that wool prices are likely to remain volatile for the next few months and possibly into 2020 before a more sustained and modest improvement will occur. A bright spot for the Chinese industry has been the popularity of two new star products that utilize significant fine wool and some broader wools to a lesser degree. Double sided wool fabric and fake faux fur (replicating wool for fur) for winter coats have been selling very well in the Chinese domestic market, examples are attached to this report.

In terms of Canadian wool production, a 9.7% increase was recorded compared to the previous wool marketing year. This is a good sign and we are hopeful for stable wool production in Canada. However, continuing drought conditions in certain parts of the country is a big concern due to the associated increased feed costs and flock reductions or dispersals that have been occurring. At the time of this writing we have marketed approximately 60% of the current year’s wool production. Under normal trading conditions we would expect to be further sold by this time of year. With the present difficult wool marketing conditions that prevail we will continue with a patient and disciplined wool marketing approach to our regular established markets as opportunities arise. Our top three export destinations for Canadian wool in 2019 will be China, Egypt and Czech Republic.

It is worth noting that the well prepared wool clips are always easier to market when times are tough compared to inferior quality wools that contain faults such as high vegetable matter, poor colour etc.

CCWG Livestock Supplies, the Real Wool Shop and Premier Choix Agricole represent the retail brands that have served the company well. This business continues to grow and achieve favourable results. Sales increased by 6.7% compared to the previous year and net profitability increased by 9.7%. Significant investment is being allocated to improving the companies online platform as this part of our business continues to expand. In order to maximize social media marketing opportunities and for future business planning and development, a marketing consultant will be providing recommendations for consideration on these initiatives.

We wish to recognize James McNeely, Wool Superintendent and Donna Zeman, Executive Director who are two long time company employee’s that are taking well deserved retirement. On behalf of all of us we thank you for your many years of loyal and dedicated service. Best wishes to both of you for many years of happy retirement.

Sincere thanks is also expressed to all staff, directors and our loyal customers for contributing to our continued success in this our 101st year of business.

Respectfully submitted,

Eric Bjergso

General Manager

CCWG Wool Market & Business Update – Fall 2018

2017/18 Wool Market Update

In the last 12 months fine wools from all origins have achieved unprecedented record prices although at the time of this writing prices have pulled back for most microns in the last couple of weeks. Unfortunately the crossbred and broader wools which are much more plentiful in supply have been left behind for the most part and have only recorded marginal increases compared to the previous year.

Respectfully Submitted,

Eric Bjergso

General Manager

30th Nanjing Wool Market Conference and Wool Trade Fair 2018

Download archives from previous years